Commercial Launch at China Space Day: Rocketing Towards Launch Diversity

Here in China, April 24th of every year is China Space Day, a date that commemorates China’s first space launch, the April 24 1970 launch of the Dongfanghong-1 satellite onboard a LM-1 rocket. This year’s China Space Day was notable in part for the avalanche of launch-related updates, indicative of China’s diversifying launch sector. From state-owned enterprises (SOEs) going commercial, to commercial players starting to ramp up capacity, this year’s China Space Day was an exhibition of the rapidly evolving industry that is hurling big metal cylinders into orbit. On the whole, the event showcased two big trends: Big, long-term ambitions for super heavy rockets, and short-term ambitions to open the industry to more commercial activity.

The conference is held in a different city every year — typically relatively smaller cities that want to develop their space sector. These have included freezing Harbin (2018), Maoist Changsha (2019), and both in-person and virtual events for recent conferences in historical Nanjing (2021), sunny Hainan (2022), and, last but not least, the slightly random Hefei (2023). As is the case every year, China Space Day included multiple conferences and symposia hosted by, among others, the China National Space Administration (CNSA), China Aerospace Science & Technology Corporation (CASC), Chinese Society of Astronautics (CSA), and of course, various local government entities.

China Unveils Starship-Esque Variant of LM-9

During one presentation, CNSA Vice Administrator Wu Yanhua unveiled a Starship-esque variant of China’s future Long March-9 rocket, to be built by CASC and various subsidiaries. The super heavy lift rocket — envisaged for entry into service in the 2030s — has seen multiple different variant concepts discussed by different characters in the upper echelons of China’s space sector. That being the case, any announcement surrounding the LM-9 (or indeed, probably any rocket not meant to fly for a decade) should be taken with a grain of salt.

That said, unlike other LM-9-related announcements, which tend to come from people such as the long-retired Long March designer Long Lehao, these announcements are slightly more credible because they came from Wu, a current leader of China’s space industry. According to Wu, the LM-9 will have three different variants: a 3-stage version with reusable 1st stage, a 2-stage version with reusable first stage, and a Starship fully reusable version, to be developed after the first two.

Wu announced that the 3-stage version of the LM-9 would be put into service between 2030 and 2035, with test launches of the 2-stage version starting around 2033. The fully reusable Starship version would see its maiden launch around 2040. All three variants would require a 200t liquid methane engine with full-flow staged combustion.

Wu also provided updates on launch capacity: The 3-stage LM-9 is expected to be able to carry a 50 ton payload into orbit (35 ton when reusable), while the 2-stage would have 150 ton capacity to LEO when expendable, and 100 ton when reusable. The fully reusable Starship variant is expected to have payload mass to LEO of 80 tons.

CASC’s Commercial Launch Push

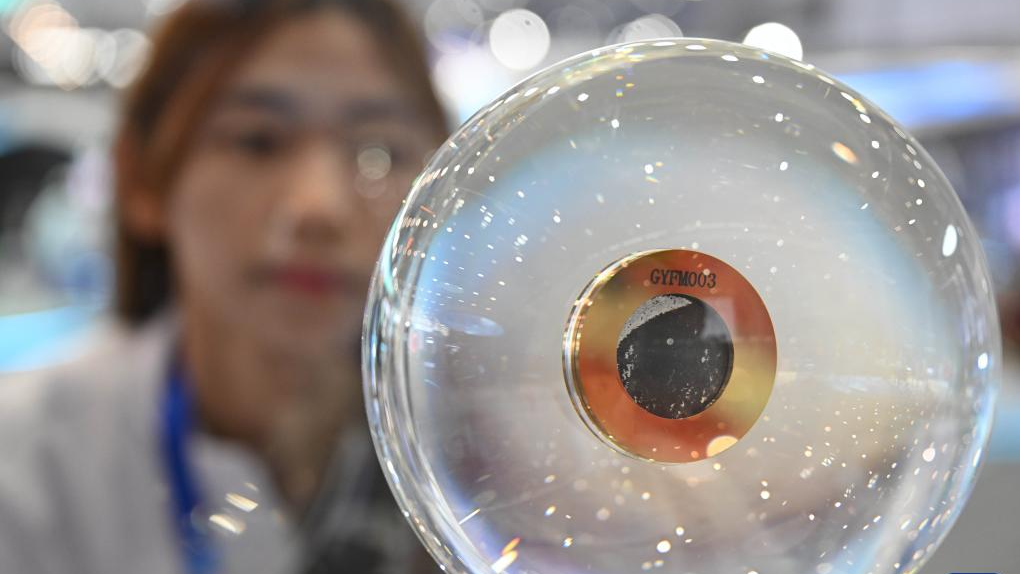

The China Space Day Conference week also included the unveiling of a new commerical launch company, and three new rocket engines to boot. A CASC subsidiary called the Academy of Aerospace Liquid Propulsion Technology (AALPT, aka the CASC 6th Academy) unveiled several new commercially-oriented rocket engines, to be commercialized by newish AALPT subsidiary Shaanxi Space Commercial Engines Company.

The engines are the YF102, YF-102V, and YF-209, with all three targeting commercial companies developing “competitive, small liquid-fueled rockets.” The YF-102 and YF-102V represent respectively a first-stage gas generator cycle kerolox engine and its vaccuum-optimized counterpart. The thrust of the two engines is respectively 85 tons and 72 ton, and can be configured in groups of three to five engines with 3.35-meter diameter rockets or five to seven engines with 3.8-meter diameter rockets. The YF-209 is a medium-thrust methalox engine with a thrust of 75 tons that is optimized for reusability.

AALPT’s event was well-attended by Chinese space industry heavyweights, including the China Academy of Launch Vehicle Technology (CALT, aka CASC 1st Academy), Academy of Aerospace Solid Propulsion Technology (AASPT, aka CASC 4th Academy), Shanghai Academy of Spaceflight Technology (SAST, aka CASC 8th Academy), and various commercial companies including CAS Space and Space Pioneer, both of whom have completed their first successful launch in the past year (Space Pioneer just last month). During the event, four of these entities (CALT, SAST, Space Pioneer, and CAS Space) signed strategic cooperation agreements with AALPT, likely indicating plans to use these new engines in their rockets. Interestingly, both Space Pioneer and CAS Space have been developing their own engines (Tianhuo-11 and Xuanyuan series), so this agreement might be a white flag by them with regard to their own engine development, or a way of trying to do right by the powers that be by buying their engines from an established, state-owned player.

In any case, the announcement by AALPT is a big deal. As recently as five years ago, the traditional space companies (read: CASC and any subsidiaries) viewed the commercial companies as completely irrelevant at best, and a bad joke at worst. Now, not only is CASC open to selling to commercial companies, but they’re creating subsidiaries and holding big product launch events that are aimed squarely at commercial companies.

One could ask: What gives? What’s changed in the past three to five years? The short answer is significant growth in the commercial space sector in China, and increasing involvement from big — but not typical — players. For example, CAS Space is strongly supported by the Chinese Academy of Sciences (CAS), which had zero commercial space presence until a few years ago. Moving forward, we should expect to see the state continue to do more to address the growing market that is commercial space companies, partly because these commercial players aren’t messing around.

The Continued Rise of Commercial Launch on Display

It’s no wonder CASC is trying to sell to commercial launch companies: These companies are growing. During the conference, Orienspace (another commercial launch player supported by CAS) inked a strategic cooperation agreement with PIESat for launch. PIESat is a remote sensing data analytics platform company, and a huge one at that. Publicly traded on the Shanghai Stock Exchange, the company is worth some ¥17.6 billion ($2.5 billion) and has a roster of customers that includes various Chinese government entities.

As a way of differentiating itself, PIESat has been planning its own SAR EO satellites, the first four of which were launched in March 2023. Moving forward, PIESat will apparently be sending some of their satellites into orbit on an Orienspace rocket. The agreement came just a few days after Orienspace announced a similar agreement with CGSTL, China’s leading commercial remote sensing company and one that has launched roughly 90 satellites as of May 2023. Orienspace plans to reach a production capacity of 20 medium- and heavy-lift rockets by an undefined date.

During the conference, leading commercial launch firm Galactic Energy inked an agreement with Tianxun Space for launch services. Tianxun plans to launch a 108-satellite remote sensing constellation, and Galactic Energy is a great candidate to provide a lift. The launch company was founded in 2018, and has since gone an impressive five out of five on launches of their Ceres-1 rocket, sending 19 satellites into orbit in the process.

Finally, CAS Space announced plans to have GTO launch capabilities by 2025. With support from the Chinese Academy of Sciences, and with a decent track record thus far, this could be plausible. But it is nonetheless a pretty ambitious goal, and one with arguably limited utility: China already has fairly regular GTO launches, and the number of GEO satellites launched by China per year is small.

Launching Into a New Era

China’s launch sector has come a long way since the launch of Dongfanghong-1 in 1970. Even in just the past decade, China has seen its annual launch cadence increase from roughly 15 per year to more than 60 per year in 2022 and likely 2023.

China Space Day 2023 saw the confirmation of a super-heavy-lift reusable rocket, as well as the continued rise of several commercial players amidst a vote of confidence by CASC/AALPT towards the commercial sector. Moving forward, we are likely to see a continued diversification of China’s launch sector, as several new players enter the fray, new commercial launch sites come online, and a wider variety of rockets are deployed into orbit.